The future of trading floors

Trading practices are among the most complex in financial services. Traditionally, centralized and co-located operations reflected trading desk needs for face-to-face communication, regulatory demand for management control in risk management, and technical preferences.

Yet, the pandemic forced many to move quickly “from centralized to anywhere,” which happened without significant disruptions. The short term was doable as regulators—understanding the challenges—eased on their requirements. However, this might not be sustainable for the long term without a fundamental review of trading room practices.

The transformational journey to the trading floor of the future will require:

- flexible workplace norms to attract and retain talent now accustomed to remote work—across all generations

- the cultivation of new business approaches and architectures to advance cloud adoption of data and AI services; and

- a refresh of risk and compliance procedures to keep pace with the virtualization of tasks on flexible operations.

Looking through the lens of time, the future of trading will be very different. This transformation will allow trading institutions to improve:

- Agility. Decouple workloads to run on the most appropriate technical infrastructure.

- Control. Create operational consistency across the trading floor based on necessity and preference, with workloads optimized for security, compliance, and latency.

- Flexibility. Adapt trading operations to match workload capacity and workforce requirements.

- Scalability. Support working conditions to sustain current and future trading volumes and workforce demands.

- User experience. Meet customer expectations and create a more responsive engagement with trading floors.

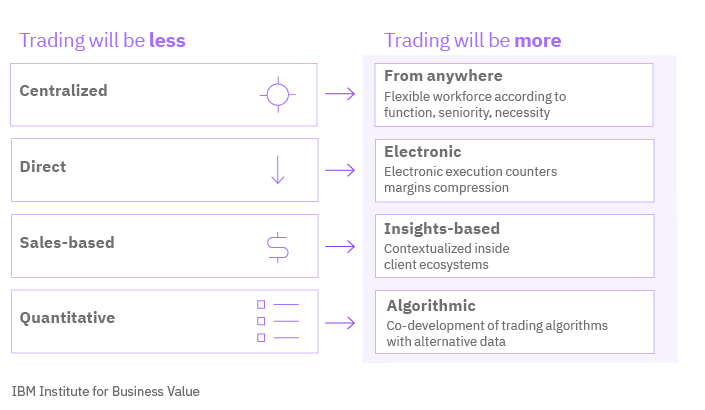

Trading floor transformation: Operations become decentralized, electronic, and based on insights and algorithms.

The emergence of new cloud-based platforms

Yesterday’s centralized trading operations can become the virtual venue. Trading rooms are transforming to future operations by moving from:

- Centralized trading to flexible access

- Centralized recovery facilities to distributed capabilities

- CPU-intense desktop processes to cloud-powered data and artificial intelligence (AI) on virtual desktops

- Ultra-low latency with physical proximity to cloud-enabled equivalent proximity

- On-premises interactions to secured virtual collaborations

- Analog relationships with clients to platform-based sales interactions

- Slow onboarding of fintech and providers to fast-tracking services on cloud-integrated collaboration platforms

To realize the flexible trading floor of the future, a culturally enabled workforce also demands new business approaches and architectures to advance their ability to exploit alternative data and AI strategies on cloud-based accessibility.

Read the full report to learn how trading platforms based on open cloud technology and advanced analytics can give your organization a virtual venue for resilient operations and a transformed trading workforce.

Meet the authors

Søren F. Mortensen, Director, Global Financial Markets, IBMTina Naser, Partner and Practice Leader, Enterprise Strategy, IBM Consulting

Laura Cheung, Associate Partner, Enterprise Strategy, IBM Consulting

Download report translations

Originally published 06 April 2021