Expanding services in engineering and construction

The built environment is a complex combination of social and economic infrastructures. Its major stakeholders include engineering and construction players and owners, manufacturers, building material providers, and governmental and regulatory entities.

The engineering and construction industry is, in turn, a highly fragmented and complex ecosystem. The industry has seen a very slow increase in productivity over the last 50 years, and it has scored at the bottom of the list for digitization. As a result, low profit margins and high costs of failure are the norm. Typical margins ranged from 2% to 7% over the last 5 years.

This ecosystem’s supply chains are also highly intricate, with limited collaboration and low visibility. Companies often must join supply chains specific to projects and clients, leading to even greater reluctance to digitize workflows. In addition, the engineering and construction industry faces a talent shortage caused by a retiring workforce, as well as a major trade skills gap.

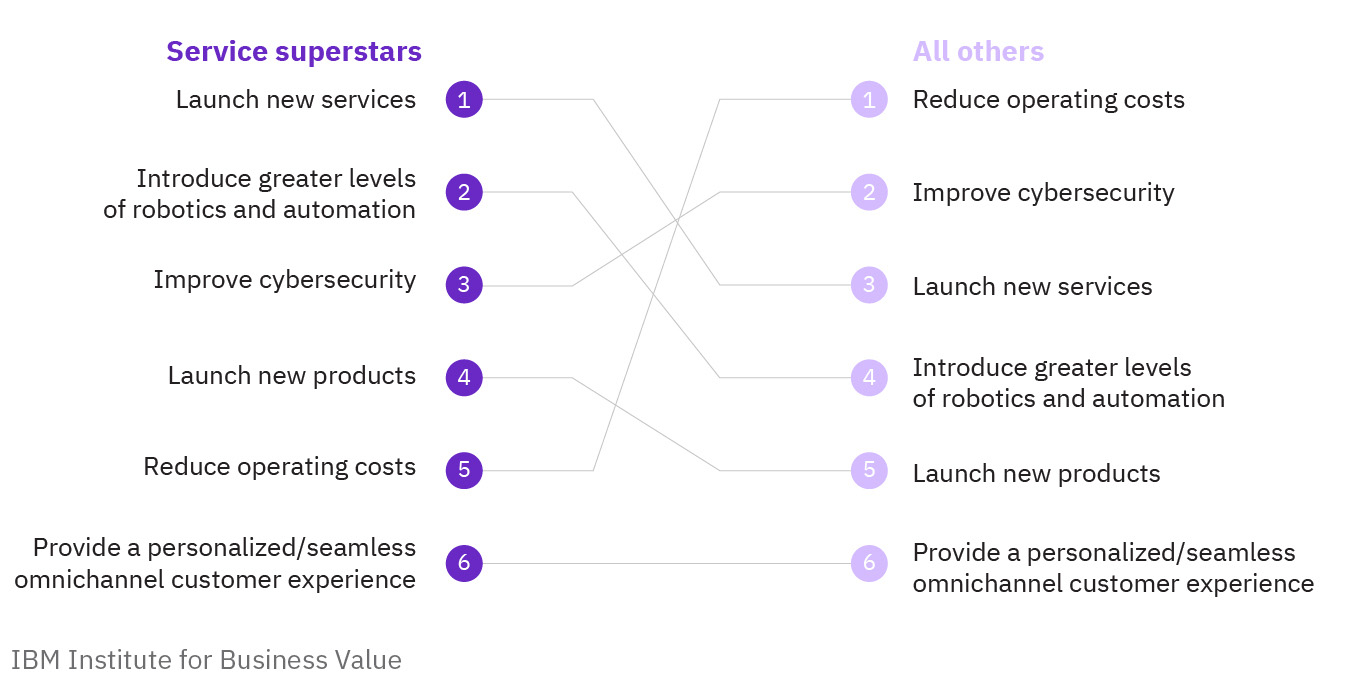

Executives view launching new services as the second most important business objective behind reducing operational costs.

The built environment ecosystem as a whole has seen a major influx of venture capital investments. Nearly 1,200 startups worldwide entered into real estate and construction between 2010 and 2017 and received around $19.4 billion in funding. These startups are taking advantage of market opportunities. Meanwhile, existing engineering and construction companies have excelled in business-specific innovations, but they are not focusing on the radical change the industry needs.

Over the next few years, this industry is expected to shift further toward a productized workflow. This approach can reduce the uniqueness of projects by selecting from catalogs or libraries of designs, stabilize the value chain with recurring business, embrace sustainability and circularity at its core, and take out a lot of on-site construction hours known for notoriously low productivity. At the center of this radical shift lies technology as the catalyst and accelerator.

The need for an expanded services strategy

In such a challenging environment, service excellence continues to be critical to the success of engineering and construction companies as they work to guard their value add and capture new opportunities. Over the last few years, engineering and construction clients have elevated their expectations for a smarter built environment including smart homes, buildings, and infrastructure. They want to optimize their energy use, resolve service issues immediately, and get more value out of their built assets.

80% of service superstars report improved customer benefits and outcomes from their technology investments.

Yet many engineering and construction companies lack the capabilities to meet their customer service aspirations. Based on net promoter score (NPS) benchmarks, the real estate/construction industry lands in the middle of the pack with a score of 27, much lower than healthcare (41) and hospitality/travel (37).

Expanding services can deliver a win-win for engineering and construction companies and for their customers. By offering additional services, companies can enhance revenue, drive better margins, provide sustainable business growth, achieve predictable income streams, and deliver higher levels of customer satisfaction.

Ranking of business objectives: Service superstars emphasize new services.

Our research indicates service superstars drive services transformation through 4 actions:

- Establish expanded services strategy and governance

- Leverage technology

- Act on data and insights

- Address change and talent

Read the full report to see how your organization can improve its service capabilities to boost revenue growth and drive profitability.

Meet the authors

Hans Bracke, Global Service Transformation Lead for Chemicals, Petroleum, and Industrial Products, IBMRagheb Halabi, Senior Managing Consultant for Chemicals, Petroleum, and Industrial Products Center of Competence, IBM

Spencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

Paul Surin, Global Engineering, Constructions, and Operations Lead, IBM

Download report translations

Originally published 08 June 2021