About cookies on this site Our websites require some cookies to function properly (required). In addition, other cookies may be used with your consent to analyze site usage, improve the user experience and for advertising. For more information, please review your options. By visiting our website, you agree to our processing of information as described in IBM’sprivacy statement. To provide a smooth navigation, your cookie preferences will be shared across the IBM web domains listed here.

New CFO horizons

Artificial intelligence has the potential to radically transform finance performance analytics capability

Artificial intelligence has the potential to radically transform finance performance analytics capability

Approaching the cognitive edge

The exponential increase in data – from Internet of Things-enabled devices, customer interactions and commercial activity – presents a goldmine of opportunity for today’s organizations. Executives across the C-suite are embracing opportunities to mine this data for insights into customer behaviors, product pricing, promotions and much more. CFOs are no exception. The 23 percent of CFOs whose companies are deemed “high performing” are twice as likely as their peers to have applied data analytics to enhance performance-insight capabilities.

But as the growth of data and speed of business outpace the capacities of finance analytics teams, new capabilities are clearly needed. The experiences of high-performing finance teams provide insights into emerging opportunities to leverage the next evolution in performance management – the cognitive advantage.

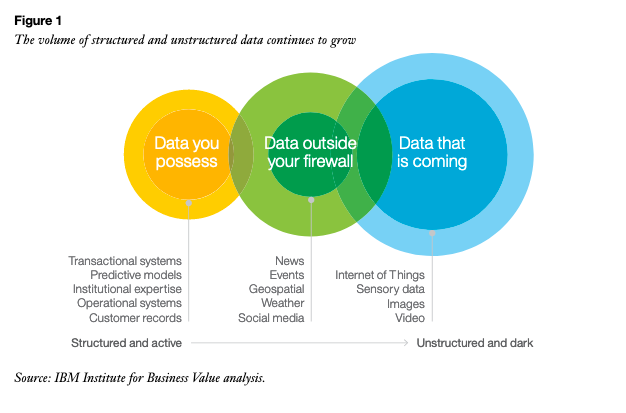

Big data has been called “the new natural resource.” And this resource continues to rapidly increase in volume, variety and complexity (see Figure 1). For the unprepared, the sheer quantity of data can create significant challenges – particularly for the analytics team within the finance department. This team must wade through volumes of data to cull insights that help explain past performance and contribute to strategies for future success.

These insights typically focus on reasons behind revenue, cost, margin and gross-profit achievements, as well as misses and upside surprises. Factors that affect performance can include changes in product and service offerings, a move into a new business, success of the sale force in closing deals or supply chain management challenges, to name a few.

Among traditional analytics tools, enterprise resource planning and performance analysis systems have played prominent roles in helping navigate the murky waters of data collection, integration, analysis and reporting. Their ability to integrate financial, operational and external data across the enterprise has become essential for most organizations. Finance departments with the strongest analytical capabilities have been the most successful in achieving this integration.

However, while most of today’s legacy analytics solutions are well-suited to analyzing structured data, they are not equipped to extract the full value of big data. The flood of new structured and unstructured data, coupled with talent gaps and the limits of human analytical insight, can overwhelm a finance analytics team.

Many organizations are beginning to turn to cognitive computing to address these challenges. As the next evolution of analytics, cognitive provides a platform to ingest, consolidate and organize vast amounts of structured and unstructured data and can be “taught” about relationships between data so it can continue to “learn” and offer speedy insights for analysts to leverage.

To understand organizations’ current approaches to and future plans for analytics and cognitive computing, we conducted research in early 2016 to complement findings from the earlier “Your cognitive future” study, focusing on responses of the 161 CFO participants (see Methodology on page 11).

This report explores the CFO perspective regarding the advantages data and analytics can provide, what outperformers are doing differently that drives their success and how cognitive computing has the potential to radically transform finance performance analytics capability.

Based on our research, CFOs consider growing revenue to be the single most important objective for their enterprises (see Figure 2). This is consistent with responses from their CxO peers. Yet, companies must achieve this growth while improving efficiency, cutting costs and meeting customer expectations.

To understand how companies succeed with these multiple objectives, we identified a small group of outperformers who told us they had both higher revenue growth and higher levels of efficiency than their peers over the last three years.

They account for 23 percent of the CFO respondents covered in our analysis. We’ll focus on their views to identify what these most successful organizations do differently to help their enterprises

Overall, outperformers have strong decision-making capabilities. They are better at addressing strategic direction, cost-reduction opportunities, investments, and customer issues than their peers.

Outperformers drive these decision-making capabilities by using data and analytics more effectively to generate and share insights, and to enable speed to action. As a consequence, they demonstrate better access to data, improved speed of analysis, and greater clarity of insights.

To achieve their enterprises’ top objective of growing revenue, outperformers are 29 percent more likely to use data and analytics to identify new business opportunities, and 20 percent more likely to use them to develop new, innovative products and services.

Bookmark this report

Share

Meet the authors

William Fuessler, Global Domain Leader for Finance, Risk and FraudCarl Nordman, Director, Global C-suite Study Program, and CFO Research Lead, IBM Institute for Business Value

Spencer Lin, Global CFO Research Lead, IBM Institute for Business Value

Download report translations

Originally published 01 August 2016

How can IBM help you?

How can IBM help you?

You might also like