Telecoms and banks connect

Online payments are now mobile. Across sectors, mobile device applications are empowering consumers to complete a wider variety of financial transactions—from shopping to banking to paying bills—with their smartphones.

This surge of digital financial services presents an urgently needed opportunity for the telecommunications industry to extend into new markets and generate additional revenue streams. Some communications service providers (CSPs) have already transformed landscapes with mobile money in emerging markets, including countries across Africa, through financial inclusion initiatives. Others are exploring an economy of things, where IoT devices complete mobile payment transactions. Yet some have been taking a wait-and-see approach to mobile financial services (MFS).

The waiting period is over. Fast-moving fintechs and startups can gain the edge if CSPs don’t move quickly. Enterprise telecom customers are also enamored: nearly two in three (63%) survey respondents said they are interested in payment solutions from their CSPs in recent research from the IBM Institute for Business Value (IBM IBV).

Established relationships plus the growth of cloud and open APIs set the stage for CSPs and banks to collaborate on mobile financial services.

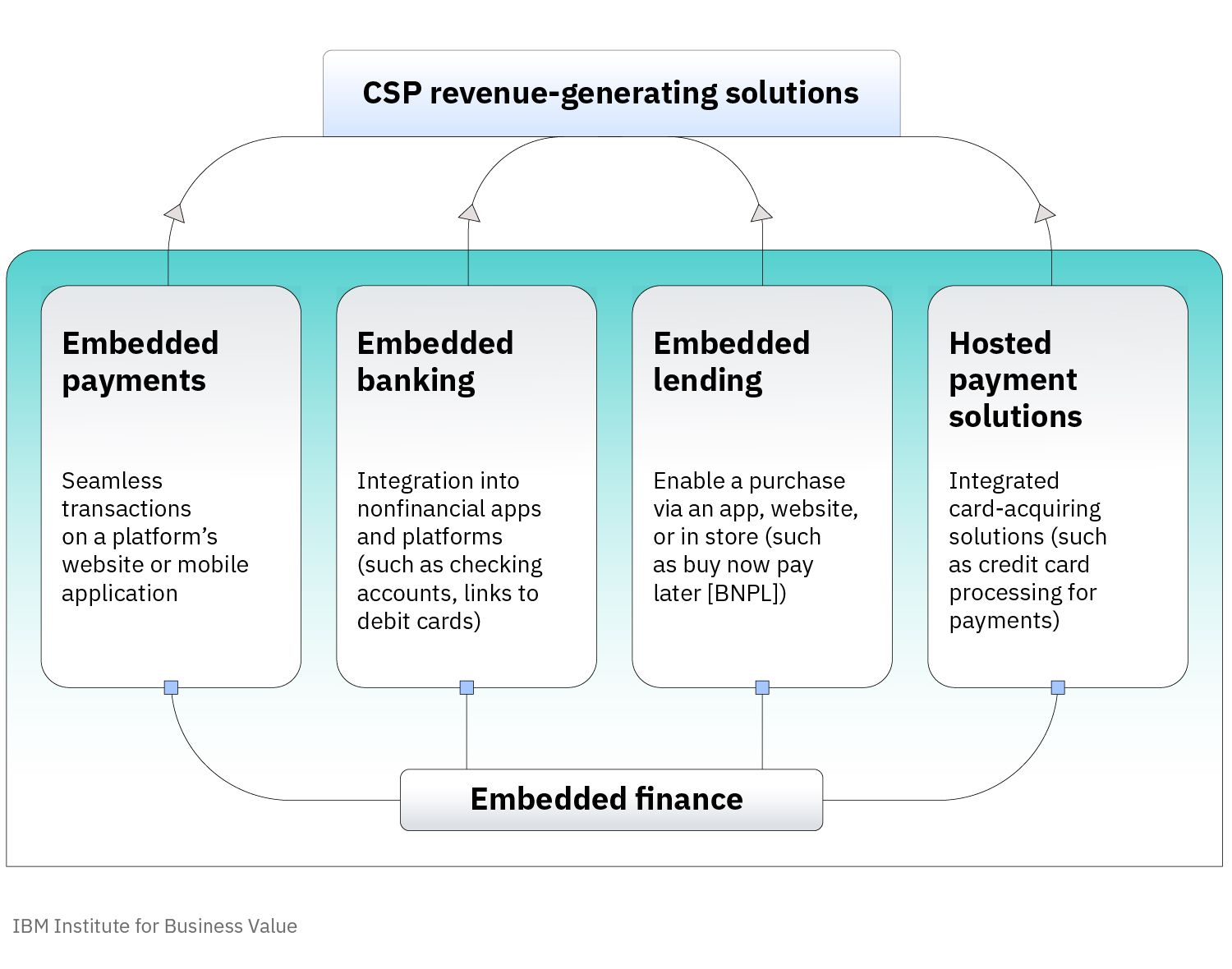

But CSPs cannot deliver these solutions alone. They must build on their current banking partnerships that are reaching the unbanked with mobile banking and mobile money services. These relationships, along with the growth of technologies, such as cloud and open application programming interfaces (APIs), set the stage for CSPs and banks to collaborate and create real-time financial and payment services. Embedded finance solutions, which directly integrate financial tools or services into nonfinancial platforms or business models, can focus on four primary areas.

CSPs and banks can collaborate on embedded finance services focused on four primary areas.

Embedded payments

Embedded payments allow customers to complete transactions seamlessly without leaving a platform’s website or mobile application. Mobile wallets can be used within an embedded payment solution.

Embedded banking

Embedded banking solutions are integrated into nonfinancial applications and platforms and enable businesses to provide slimmed down banking services to customers in a single client experience.

Embedded lending

Embedded lending solutions expand beyond mobile payment systems and are designed to offer consumers more seamless access to financial products and services that enable a purchase through apps, websites, or in store.

Hosted payment solutions

These services permit a company to have a fully integrated card-acquiring solution, offering credit card processing for payments. Payment solutions in this space offer business management tools to help small businesses get up and running as well as take payments for their services.

Download the report to explore three critical steps for CSPs and banks to take to create innovative, revenue-generating embedded finance solutions. An action guide outlines more specific ways leaders can get started in the mobile financial services market.

Meet the authors

Jennifer Acosta, Managing Director, Global Head of Media and Telecommunications North America, Head of Enterprise Technology, J.P. Morgan PaymentsStephen Rose, General Manager, Global Industries, IBM

John J Duigenan, General Manager, Financial Services, Banking, Financial Markets, and Insurance Global Industries, IBM Technology

Priya Kurien, Global Telecommunications, Media, & Entertainment Leader, IBM Institute for Business Value

Download report translations

Originally published 23 January 2024