About cookies on this site Our websites require some cookies to function properly (required). In addition, other cookies may be used with your consent to analyze site usage, improve the user experience and for advertising. For more information, please review your options. By visiting our website, you agree to our processing of information as described in IBM’sprivacy statement. To provide a smooth navigation, your cookie preferences will be shared across the IBM web domains listed here.

Data sharing across transport ecosystems

Simplifying the supply chain can improve the customer experience and deliver a competitive advantage.

Simplifying the supply chain can improve the customer experience and deliver a competitive advantage.

For decades, transportation executives viewed the industry as a cut-throat competition to win the business of global shippers. In this view of the market, the ongoing battle for freight volumes defined most interactions in the supply chain. Prevailing incentives justified the frequent addition of complex and costly services to win contracts, the near-constant undercutting of freight rates, and almost any sacrifice that would increase market share.

Fortunately, at the insistence of ever more powerful global shippers, the industry has been shaken out of this destructive paradigm and forced to consider ecosystems as an alternative to counterproductive rivalries. The transportation industry is quickly recognizing that working together in ecosystems has set the industry on a course toward happier customers, more profitable providers, and a more sustainable future for the entire industry.

Ecosystems deliver value for customers by smoothing over operational choke points.

Global supply chains have typically been highly complex systems of interdependence and mutual exchange. Visionary leaders, the very leaders that forged the earliest examples of transportation ecosystems, know that thriving in the transportation market demands cooperation among partners, competitors, and even rivals. Isolated operational efficiency gains that do not translate into noticeable improvements for shippers fail to win new business or generate price premiums.

Because so much of what global shipping buyers depend on is driven by interactions and hand-offs among transportation service providers, improvements made by individual transport companies rarely translate into significant efficiency gains to the overall supply chain. Transportation leaders have come to understand that ecosystems offer the potential to deliver the types of improvements customers require.

52% of ecosystem experts expect ecosystems to improve cross-partner collaboration and interoperability.

The IBM Institute for Business Value (IBV), in collaboration with Oxford Economics, conducted a comprehensive survey of providers who participate in transportation ecosystems. Data was collected from executives from 500 transportation providers across 14 countries between November 2019 and January 2020. In this report, we share the insights, strategies, and future plans of study participants, as well as our recommendations on how other transportation providers can optimize the benefits of transportation ecosystems in the years ahead.

Transportation ecosystems can offer a competitive advantage

In the recent past, the word “ecosystem” was rarely uttered in the halls of global transportation providers. The concept, according to prevailing wisdom, applied to cutting-edge technology companies, not to the companies that use heavy machines and diesel fuel to move cargo around the globe. It is stunning how quickly and how completely this paradigm has shifted.

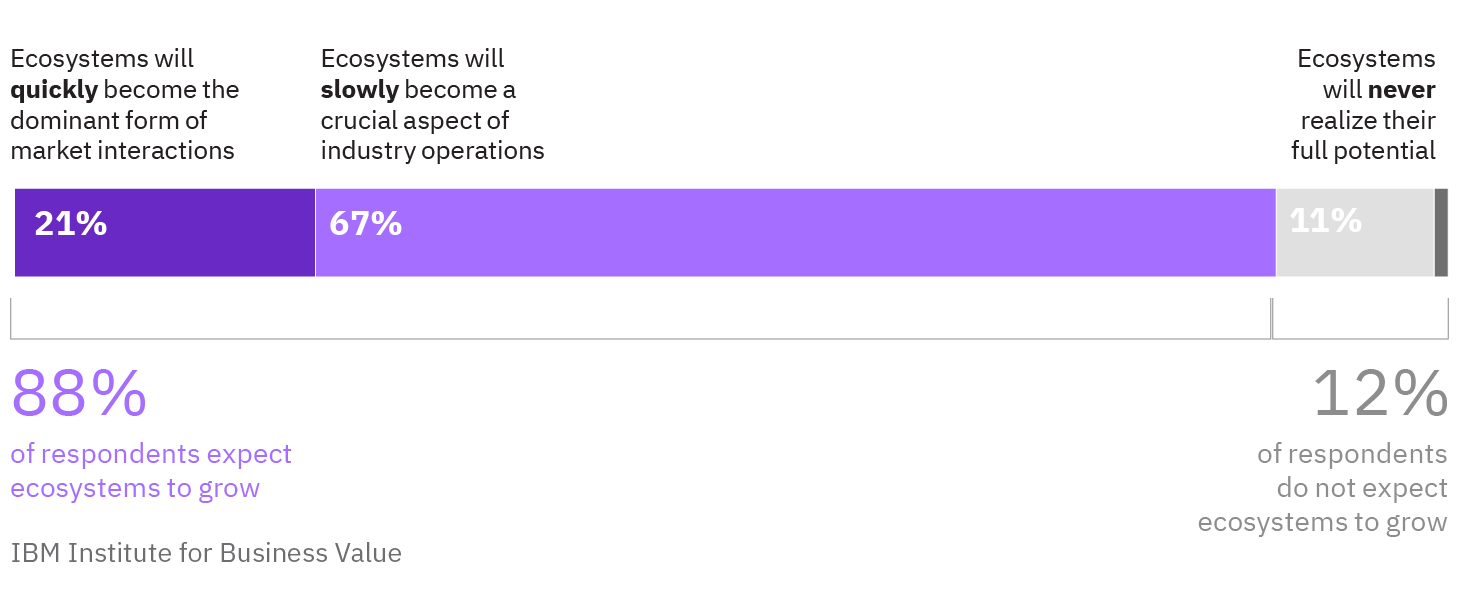

Today, because ecosystems are so deeply embedded in the strategies and plans of the global transportation industry, not a single respondent to our ecosystem survey suggested that ecosystems would quickly fade from view or decline into irrelevance. In fact, while a small handful of respondents (1%) believe ecosystems will not gain much more traction in the next 5 to 10 years, the vast majority (88%) expect that ecosystems will either continue to gain traction or will quickly come to dominate market interactions in the industry. Ecosystems, it seems, are here to stay.

The growing popularity of transportation ecosystems may be helping to spread new revenue with a broader base of industry participants.

The growth of ecosystems in the transportation industry is partially explained by the fact that companies find them “addictive,” and then often subsequently increase the depth and breadth of their ecosystem involvement. Indeed, 80% of transportation companies that are involved in an ecosystem today plan to maintain or increase ecosystem involvement in the next 3 years. Even more telling is the fact that fully 10% of companies plan to start a new ecosystem in the same period.

Investment plans also point to continued growth in transportation ecosystems. Transportation companies are currently directing about 9% of their investment capital toward ecosystems. Companies that start down the ecosystem path continue to increase their financial commitment to ecosystems each year, leading 11% of corporate investments toward ecosystems in the next 3 years.

Spreading like wildfire: 67% of respondents expect ecosystems to gain traction slowly and steadily.

Read the full report to see what separates ecosystem experts from their peers, and to discover how ecosystems can improve the customer experience.

Bookmark this report

Share

Meet the authors

Dee K. Waddell, Global Managing Director, Travel & Transportation, IBM Global MarketsSteven Peterson, Global Thought Leader, IBM Institute for Business Value

Originally published 21 April 2021

How can IBM help you?

How can IBM help you?

You might also like