Transforming chemical industry services

For chemical companies, offering and delivering services are critical to address the disruptive market forces driving industry shifts. With decreasing product profit margins and limited brand loyalty, these companies are struggling with how to differentiate their value—whether through cost, features, or quality. The COVID-19 pandemic has exacerbated difficulties with significant disparities in the demand for chemical products.

Many chemical companies lack the capabilities to meet their customer service aspirations.

Customers are demanding more personalized service. They expect service representatives to resolve immediate issues, as well as serve as trusted advisors that help them gain more value out of purchased products. Yet many companies lack the capabilities to meet their customer service aspirations. Customers are not impressed with the experiences provided by manufacturing companies—only 15% give the industry high marks in experience—beating out only organizations from the automotive and government industries and significantly lagging behind the 45% of the top industry, technology.

To drive growth, chemical companies have shifted from not only selling products but also offering a broad range of services. Service offerings can be based on product, performance, and/or usage:

- Product-based services: add services to existing products, for example, engineering services

- Value-added services: provide additional value, for example, knowledge and advisory services

- Process optimization services: provide process efficiency improvements, for example, services to achieve desired results

- Outcome-based services: deliver business outcomes, for example, management of total product cost as opposed to a product sale

State of chemical industry services

Chemical executives recognize the business need for services. Nearly three in five told us that customer/consumer behavior is shifting from product-based to experience-based. 55% indicated that traditional business models are not sustainable in the current market environment. And ongoing commoditization of products is reflected by over half of respondents, who agreed that differentiation is dramatically decreasing in terms of products, prices, quality, and delivery terms.

55% of chemical executives say traditional business models are not sustainable in the current market environment.

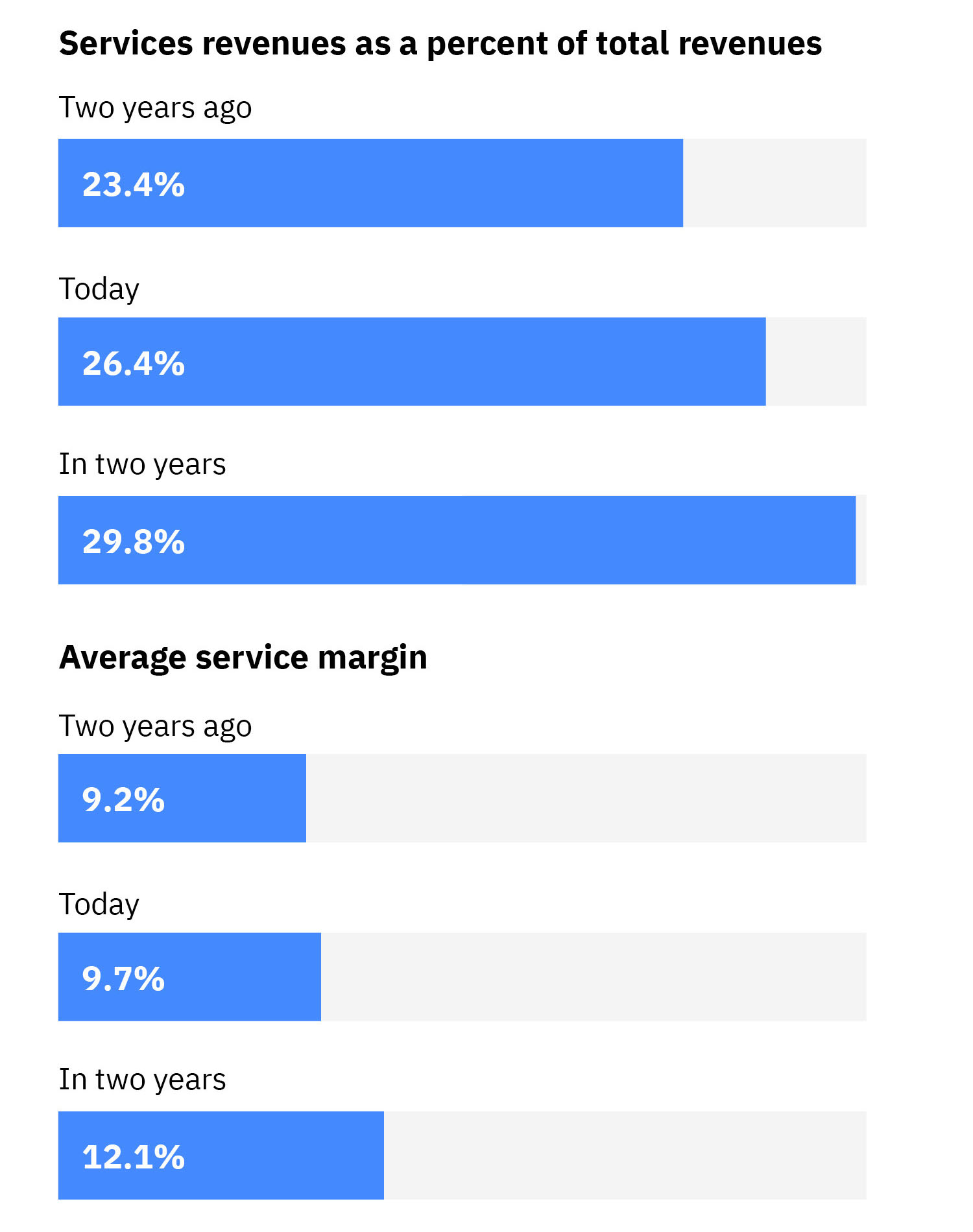

The importance of services is reflected in the companies’ business objectives. While nearly three in five executives surveyed indicated they are focused on reducing operational costs today, launching new services was second in importance at 50%, followed by launching new products and improving cybersecurity. This services priority is reflected in the growth of services revenues and margins. The expectations are that both will continue to grow in the future. This growth is supported by the expected increase in service offerings over the next two years.

Growth in chemicals: Service revenues and margins will continue to grow in the future.

To help organizations improve their service capabilities, we analyzed survey responses and identified a small group of chemical “service superstars,” consisting of one in five (19%) of our survey sample. These executives self-reported that their organizations had a well-defined services strategy that their employees understand.

These leaders deliver better financial performance than industry peers—69% versus 46% for revenue growth and 72% versus 47% for profitability. These service superstars self-reported that they outperform in innovation—78% compared with 40% for their cohorts—which is important in creating specialized service capabilities. The excel at service customer satisfaction and their average service delivery cost is nearly 40% lower. They are also more much effective against their most important business objective, launching new services—a whopping 92% versus 52% for all others.

Read the full report to learn the unique business priorities of service superstars, and what actions set them apart from the competition.

Meet the authors

Viswanath Krishnan, Global Solutions ExecutiveHans Bracke, Global Service Transformation Lead for Chemicals, Petroleum, and Industrial Products, IBM

Spencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

Originally published 08 March 2021